Anne Arundel Real Estate Records

FY26 Property Tax Bill Information Anne Arundel County Government

Message from County Executive Pittman Dear Anne Arundel County Taxpayer, Since becoming County Executive, I’ve worked with my staff to redesign the budget process around you. This year, we maintained that transparent and open process by hosting 8 Budget Town Halls – one in each Council District, and another in Spanish.

https://www.aacounty.org/finance/tax-information/real-property-tax/fy26-property-tax-bill-information

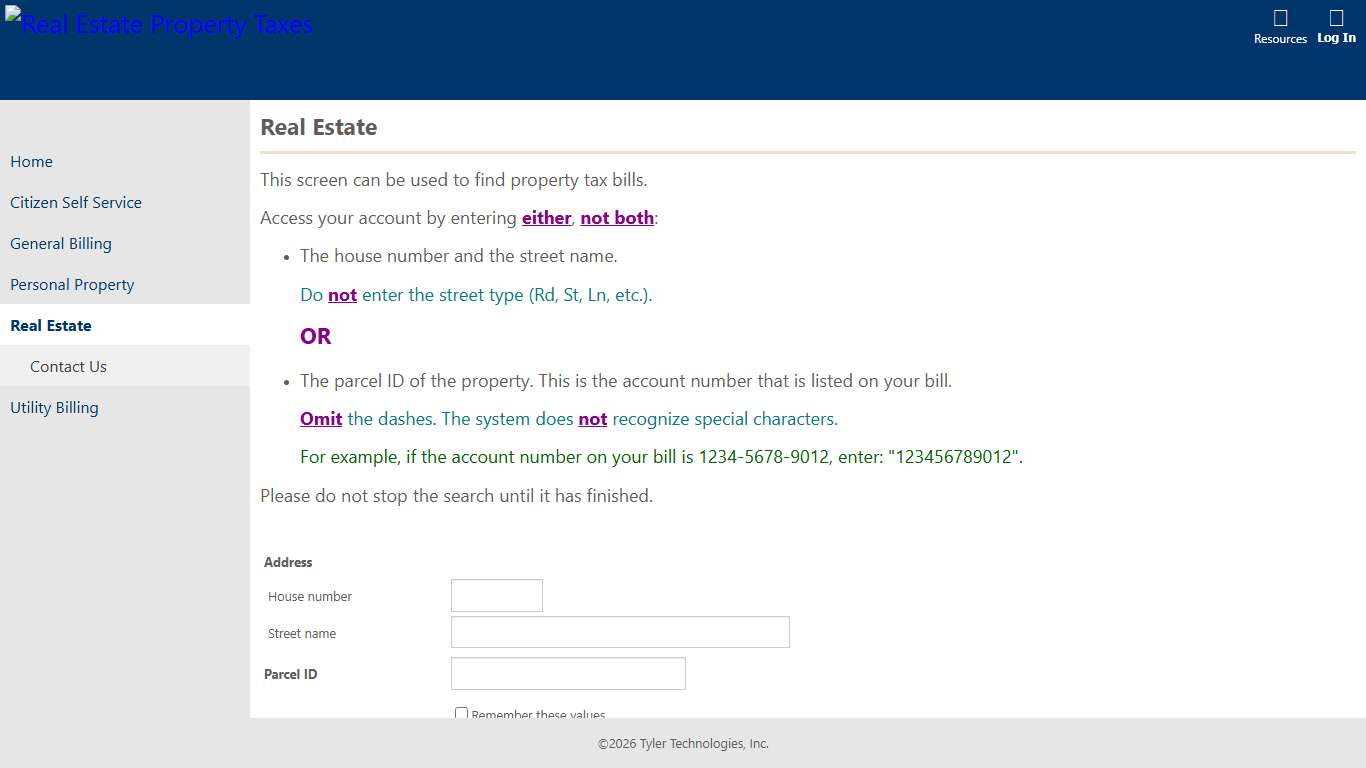

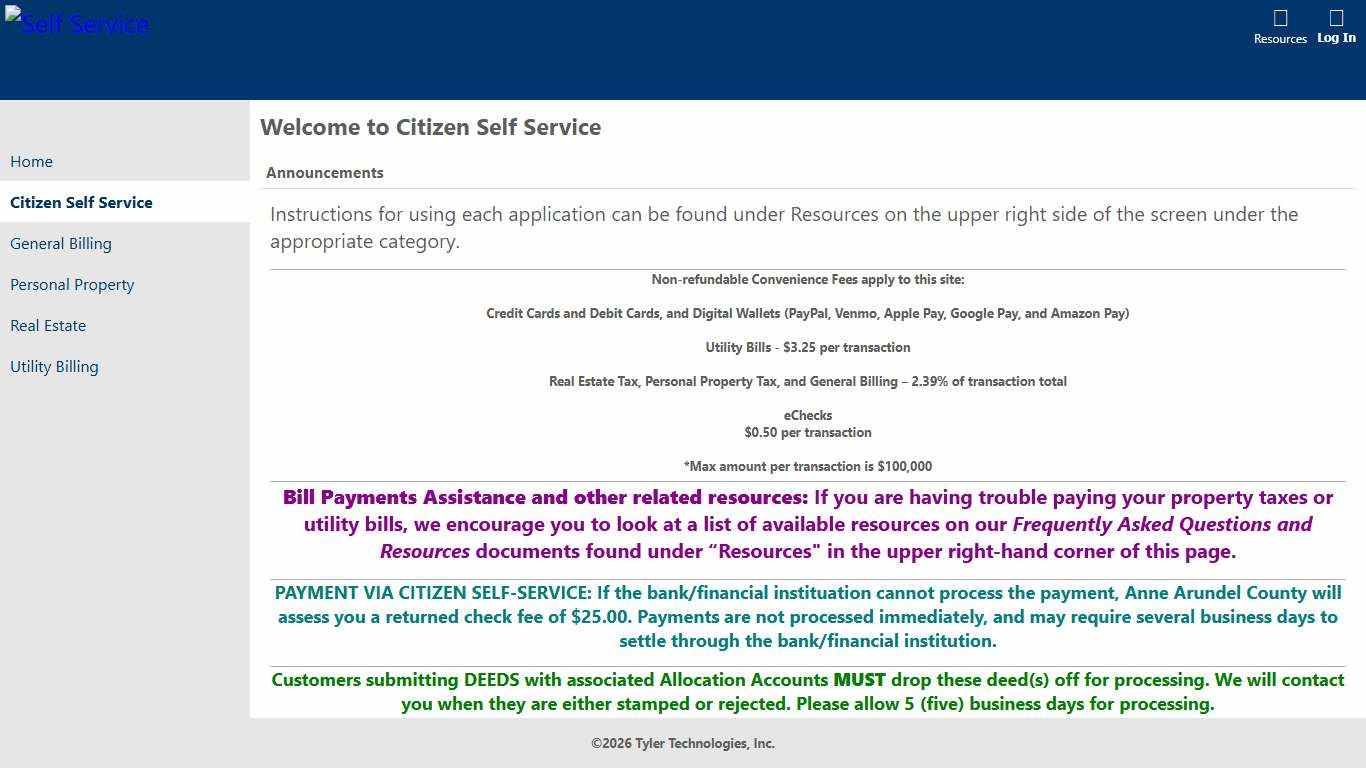

Real Estate Property Taxes

Real Estate Property Taxes. Munis Self Service. Resources. How to look up a bill · How to look up a bill · How to pay a bill ... Tyler Technologies, Inc.

https://aacounty.munisselfservice.com/citizens/RealEstate/Default.aspx?mode=new

Real Property Tax Anne Arundel County Government

Real property taxes are due and payable without interest as of the first day of July in each taxable year. The deadline for real property taxes is September 30th, as interest and penalties begin to accrue on October 1st. Real property taxes on owner-occupied property are payable via semi-annual installments.

https://www.aacounty.org/finance/tax-information/real-property-tax

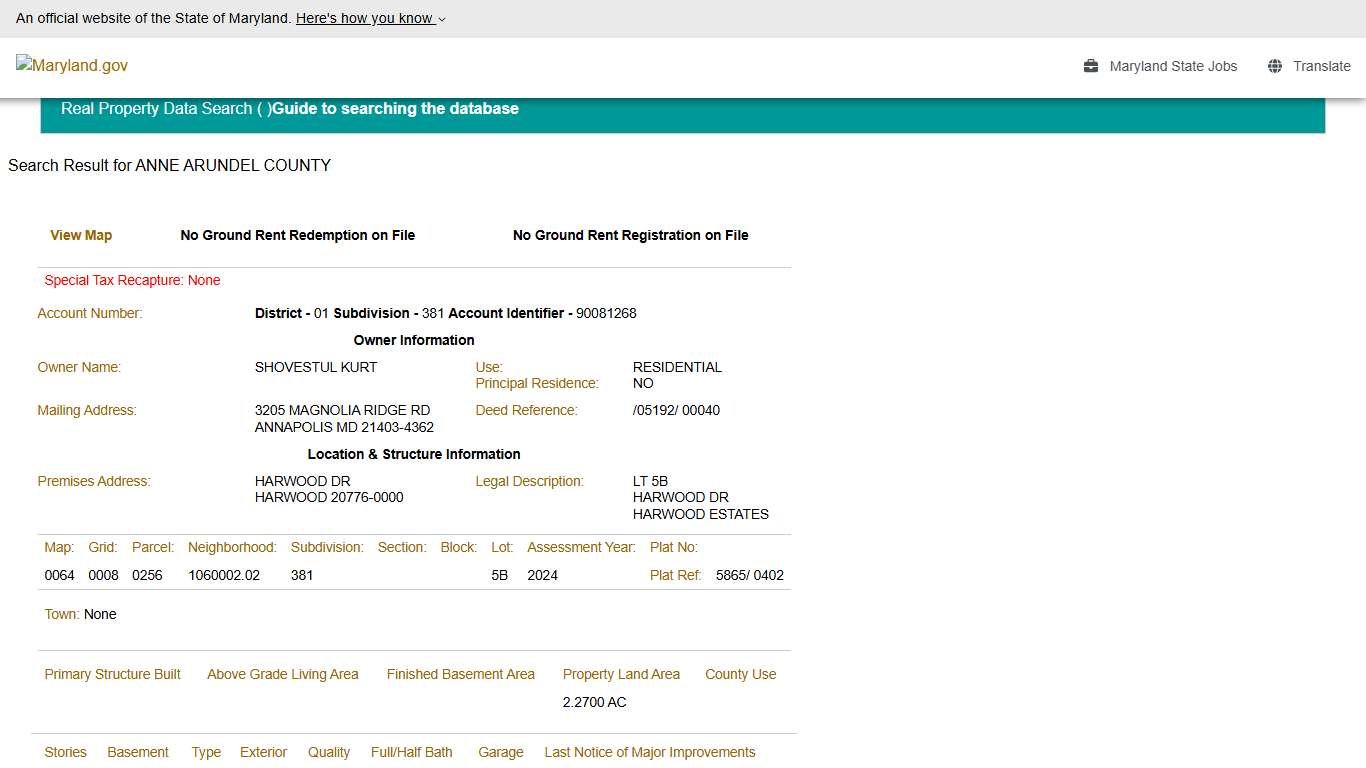

SDAT: Real Property Data Search

The Maryland Department of Information Technology (“DoIT”) offers translations of the content through Google Translate. Because Google Translate is an external website, DoIT does not control the quality or accuracy of translated content. All DoIT content is filtered through Google Translate which may result in unexpected and unpredictable degradation of portions of text, images and the general appearance on translated pages.

https://sdat.dat.maryland.gov/RealProperty/Pages/viewdetails.aspx?County=02&SearchType=ACCT&District=01&AccountNumber=90081268&subDiv=381

Real Estate Division Anne Arundel County Government

Main Functions - Property management, including leasing surplus office space for commercial and non-profit interests, leasing sites for telecommunications and water towers and monitoring property boundaries for encroachments. - Sell, transfer, and manage surplus real property in accordance with all policy and procedures as outlined in the County Code.

https://www.aacounty.org/central-services/real-estate

Property tax assessments to rise across Maryland in 2026 ...

Property tax assessments to rise across Maryland in 2026 by average of 12.7% ... I pay at close to the top rates in Anne Arundel county.

https://www.reddit.com/r/maryland/comments/1q0p9of/property_tax_assessments_to_rise_across_maryland/Land Records

These departments maintain records about real property in the county ... Maryland Judiciary. All rights reserved. Terms of Use/Disclaimer.

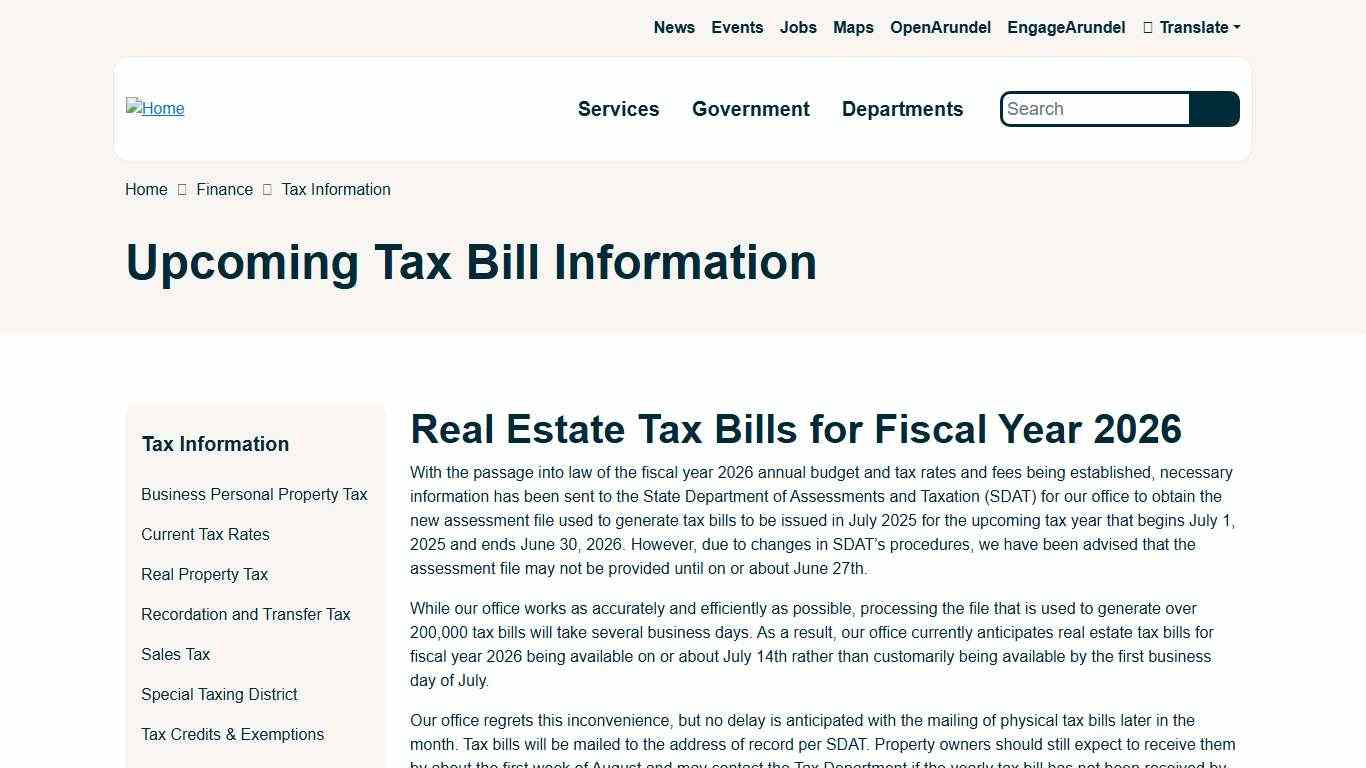

http://www.mdcourts.gov/legalhelp/landrecordsUpcoming Tax Bill Information Anne Arundel County Government

Real Estate Tax Bills for Fiscal Year 2026 With the passage into law of the fiscal year 2026 annual budget and tax rates and fees being established, necessary information has been sent to the State Department of Assessments and Taxation (SDAT) for our office to obtain the new assessment file used to generate tax bills to be issued in July 2025 for the upcoming tax year that begins July 1...

https://www.aacounty.org/finance/tax-information/upcoming-tax-bill-information

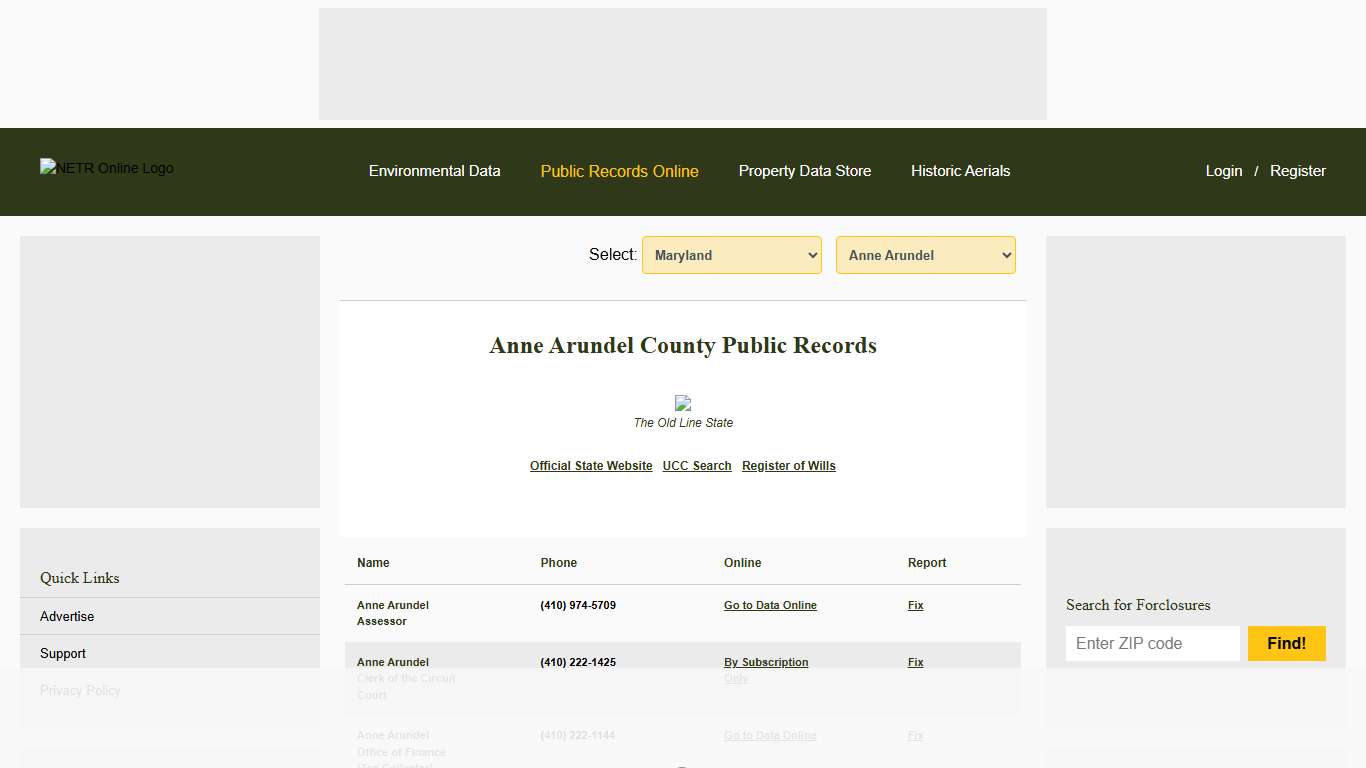

NETR Online • Anne Arundel • Anne Arundel Public Records, Search Anne Arundel Records, Anne Arundel Property Tax, Maryland Property Search, Maryland Assessor

Select: Anne Arundel County Public Records The Old Line State Anne Arundel Assessor (410) 974-5709 Anne Arundel Clerk of the Circuit Court (410) 222-1425 Anne Arundel Office of Finance (Tax Collector) (410) 222-1144 Anne Arundel Mapping / GIS Anne Arundel NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store Comparable Properties Reports...

https://publicrecords.netronline.com/state/MD/county/anne_arundel

Property Tax Billing & Collections Queen Anne's County, MD - Official Website

The Property Tax Billing and Collections section of the Treasury Division is responsible for the billing and collection of real property taxes, road and tax ditch bills. Payments are accepted in the form of cash, credit card or check and we do accept postmark.

https://www.qac.org/619/Property-Tax-Billing-Collections

Sell Tax Delinquent House in Anne Arundel County, MD 2026 Guide

Tax Delinquency in Anne Arundel County: A Homeowner’s Guide to the 2026 Tax Sale If you have received a “Notice of Sale” from the Anne Arundel County Office of Finance, you are likely feeling overwhelmed. The language is confusing, and the threat of an auction is scary.

https://www.consistenthomebuyers.com/tax-delinquency/anne-arundel-county/

Upcoming Tax Bill Information Anne Arundel County Government

Real Estate Tax Bills for Fiscal Year 2026 With the passage into law of the fiscal year 2026 annual budget and tax rates and fees being established, necessary information has been sent to the State Department of Assessments and Taxation (SDAT) for our office to obtain the new assessment file used to generate tax bills to be issued in July 2025 for the upcoming tax year that begins July 1...

https://www.aacounty.org/finance/tax-information/upcoming-tax-bill-information

Self Service

NOTE: Citizen Self-Service is unavailable nightly from 12:45 AM until 2:00 AM for system maintenance. Processing... Tyler Technologies, Inc.

https://aacounty.munisselfservice.com/citizens/default.aspx

Land Records Maryland Courts

Disclaimer Please note that the Office of the Clerk is prohibited by law from rendering any legal advice and performing title searches. The links below may be used to research land records, liens, and plats on-line. - MDLandRec.Net - CASESEARCH - PLATS.NET (A digital image retrieval system for land record indices in Maryland) In addition to records available at the Clerk's Office, the Maryland State Archives is the central repository...

http://www.courts.state.md.us/clerks/queenannes/landrecords

Assessment & Taxation Lac Ste. Anne County

Property and business taxes are key sources of revenue for any region. These revenues allow the County to deliver the many programs, services and utilities on which ratepayers rely. To ensure all property and business owners pay their fair share of municipal taxes, The County conducts assessments that reflect the market value for the property or the typical net annual rental rate for business as of July 1 of the...

https://lsac.ca/our-county/assessment-taxation

Department of Assessments and Taxation

Sign up now to receive reminders and news updates from SDAT! Thanks for subscribing! You will successfully signed up to receive emails from SDAT. The Maryland Department of Information Technology (“DoIT”) offers translations of the content through Google Translate. Because Google Translate is an external website, DoIT does not control the quality or accuracy of translated content.

https://dat.maryland.gov/Pages/default.aspx